The U.S. economy is off to a bit of a rocky start in 2014, something that might actually benefit homebuyers this busy spring homebuying season. The unsteady – and frankly, at times unpredictable – economy has allowed mortgage rates to hit yearly lows as recently as the first week in… read more →

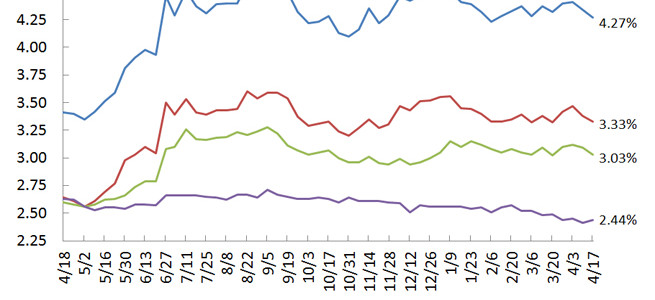

Mortgage rates in the U.S. fell, sending costs for 30-year loans to the lowest since early February as the Federal Reserve confirmed its commitment to provide support for the economic recovery. The average rate for a 30-year fixed mortgage was 4.27 percent this week, down from 4.34 percent, according to… read more →

U.S. mortgage rates for 30-year loans climbed for a third week, increasing borrowing costs as harsh weather contributes to slowing demand for homes. The average rate for a 30-year fixed mortgage was 4.37 percent this week, up from 4.33 percent, Freddie Mac said on Thursday. The average 15-year rate rose… read more →

A lot of attention has been paid to the fact that mortgage rates are expected to rise throughout 2014. As mortgage rates creep upward in this year, borrowers need remember that rates will still be historically low and nowhere near the interest rates consumers faced in the early 1980s. Four… read more →

The average interest rate on a 30-year fixed-rate mortgage hit 4.23 percent this week, the lowest since November. U.S. mortgage rates for 30-year loans fell for a fifth week as stock market volatility and weaker-than-expected economic reports drove investors to the safety of the government bonds that guide borrowing costs. The… read more →