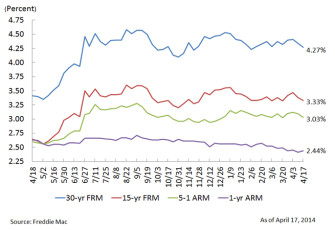

Mortgage Rates Fall to a 2 Month Low

Mortgage rates in the U.S. fell, sending costs for 30-year loans to the lowest since early February as the Federal Reserve confirmed its commitment to provide support for the economic recovery. The average rate for a 30-year fixed mortgage was 4.27 percent this week, down from 4.34 percent, according to a statement on Thursday from Freddie Mac. The average 15-year rate dropped to 3.33 percent from 3.38 percent, the McLean, Va.-based mortgage-finance company said.

Mortgage rates in the U.S. fell, sending costs for 30-year loans to the lowest since early February as the Federal Reserve confirmed its commitment to provide support for the economic recovery. The average rate for a 30-year fixed mortgage was 4.27 percent this week, down from 4.34 percent, according to a statement on Thursday from Freddie Mac. The average 15-year rate dropped to 3.33 percent from 3.38 percent, the McLean, Va.-based mortgage-finance company said.

The central bank has been scaling back bond purchases that have bolstered the housing market by keeping interest rates low. Federal Reserve Chairwoman Janet Yellen said on Wednesday that support will continue even as policy makers see the economy reaching full employment by late 2016. “These speeches from Yellen are meant to remind the public that the exit will be slow, not that it will not happen,” Neil Dutta, head of U.S. economics at Renaissance Macro Research LLC in New York, said in a note to clients on Wednesday.

The U.S. jobless rate was 6.7 percent in March, more than a percentage point higher than policymakers’ estimate for full employment of 5.2 to 5.6 percent, according to Yellen. Slow wage growth, higher home prices and tight credit are contributing to a slowdown in the real estate recovery. Builders began work on fewer homes than economists expected in March and permits for future projects declined. Housing starts climbed 2.8 percent from February to a 946,000 annualized rate, Commerce Department data showed on Wednesday. Economists expected an increase to 970,000.

Information from Bloomberg