Beginning this week, thousands of home buyers will be unable to get approvals for their mortgages because of the government shutdown, potentially undercutting the nation’s resurgent housing market. Without paperwork from the Internal Revenue Service, the Social Security Administration and in many cases the Federal Housing Administration, banks and other… read more →

Attention all families!! This weekend grab the younger generation and head out to Fall for Fairfax KidsFest. Enjoy exciting, interactive and educational programs, entertainment and activities. Fall For Fairfax KidsFest is specially designed for families with elementary & Pre-K aged children. Plus, admission is totally free! The 21st annual Fall For Fairfax… read more →

Two long-held notions about baby nurseries are being thrown out with the bath water: 1. The baby’s space is confined to a single room. 2. The baby’s room is all about the baby. With multiple kids and busy careers, new moms and dads are letting the baby take over the… read more →

Mortgage rates crept up more than 1% from May to July. But are higher mortgage rates really so terrible? Is there a silver lining or two? Here are four benefits about rising mortgage rates. Rising Rates are Often a Sign of an Improving Economy Rising interest rates are, according to… read more →

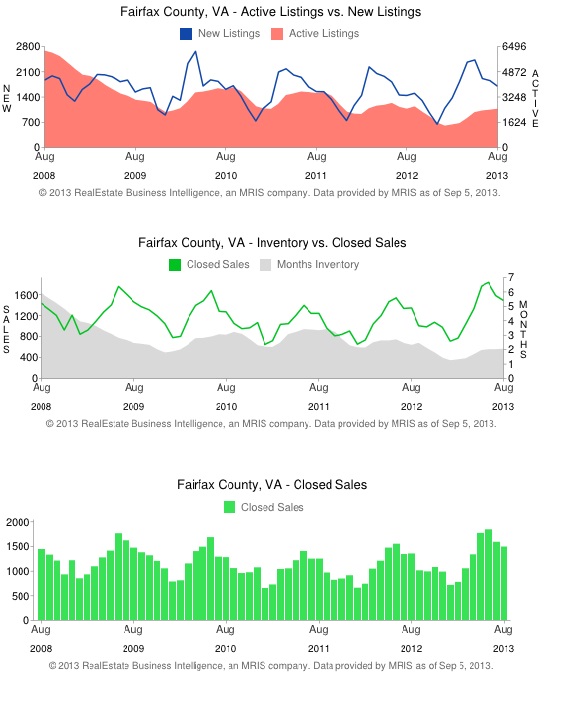

The nation’s housing recovery continues, but the best news is that sales volume in our Northern Virginia footprint has increased by about 12 percent throughout 2013 above the number of homes sold year-to-date last year. August home sales in Northern Virginia continue to defy sequestration and interest rate increases and… read more →

Each decade has had its share of questionable home design, from the extensive wood paneling and Harvest Gold appliances of the 1970s to the next decade’s overuse of glass blocks, vertical blinds and country-style decor. Some of these serve as powerful buyer-repellant; others just ding the price, as people figure… read more →

The competition for rental homes is heating up as more Americans choose to rent instead of buy. That increase in demand is driving up rents in some markets. Consider these eye-opening statistics: 25% of renters spend more than half of their income on rent and utilities, according to a recent… read more →

The average fees that mortgage lenders charge consumers to close on a home loan have increased in the past year in most states, with Hawaii being the most expensive. A homebuyer getting a $200,000 loan pays an average of about $2,400 in origination and third-party fees, such as the appraisal,… read more →

The Obama administration wants to create a mortgage market that is more forgiving to borrowers who lost their homes due to the recession, an effort that could widen the pool of potential homeowners. A recent rule change lets certain borrowers who have gone through a foreclosure, bankruptcy or other adverse event—but who have repaired… read more →

You don’t have to pay full price for your home insurance. There are lots of discounts you may be eligible for, including some very basic ones, and all you have to do is ask. Insurance companies try to provide an opportunity for customers to lower their premiums. Getting cheap home… read more →