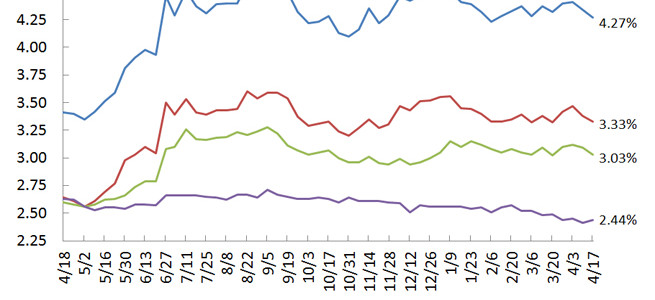

Mortgage rates in the U.S. fell, sending costs for 30-year loans to the lowest since early February as the Federal Reserve confirmed its commitment to provide support for the economic recovery. The average rate for a 30-year fixed mortgage was 4.27 percent this week, down from 4.34 percent, according to… read more →

The appraiser is due in an hour. The beds are unmade, breakfast dishes in the sink and toys scattered about the playroom. Would she care? After all, lowball appraisals can kill deals. They can also kill a refinancing application. If an appraisal comes in too low, it’s not worth… read more →

U.S. mortgage rates for 30-year loans climbed for a third week, increasing borrowing costs as harsh weather contributes to slowing demand for homes. The average rate for a 30-year fixed mortgage was 4.37 percent this week, up from 4.33 percent, Freddie Mac said on Thursday. The average 15-year rate rose… read more →

A lot of attention has been paid to the fact that mortgage rates are expected to rise throughout 2014. As mortgage rates creep upward in this year, borrowers need remember that rates will still be historically low and nowhere near the interest rates consumers faced in the early 1980s. Four… read more →

You likely have better things to do with your money than to prepay a low-rate, tax-deductible debt such as a mortgage. Only about half of homeowners receive any tax benefit from their mortgages. Many don’t pay enough interest on their loans to itemize their deductions, either because their mortgages are… read more →

The average interest rate on a 30-year fixed-rate mortgage hit 4.23 percent this week, the lowest since November. U.S. mortgage rates for 30-year loans fell for a fifth week as stock market volatility and weaker-than-expected economic reports drove investors to the safety of the government bonds that guide borrowing costs. The… read more →

Getting a mortgage can mean keeping track of a lot of moving parts. Savvy shoppers know to ask lenders about interest rates, closing costs and how much they can borrow. But even seasoned buyers may not know to dig a little deeper. Here’s a look at five key things that… read more →

For many people, New Year’s resolutions often lose their motivational power by the middle of January. But unlike a commitment to save more or eat less, a resolution to refinance can be accomplished within a few weeks and you can reap the benefits for the rest of the year and… read more →

The world of mortgage lending has changed significantly since the housing bubble burst. Mortgage lenders have returned to traditional loan standards that require extensive documentation of income and assets for a loan approval. Government regulatory agencies also continue to react to the housing crisis, with more adjustments to mortgage requirements… read more →

When thinking about your New Year’s resolutions, don’t forget to include a few items related to your home and finances. An annual evaluation will help you make sure you’re taking care of your property properly. Check Up on Your Homeowners Insurance Check the limits of your coverage to make sure… read more →