You likely have better things to do with your money than to prepay a low-rate, tax-deductible debt such as a mortgage. Only about half of homeowners receive any tax benefit from their mortgages. Many don’t pay enough interest on their loans to itemize their deductions, either because their mortgages are… read more →

For housing, it was a tale of two halves in 2013. During the first half, unusually low supplies of homes and low rates spurred bidding wars, pushing prices up sharply. During the second half, the frenzy cooled amid a sudden spike in interest rates. While more markets are now reporting… read more →

The average interest rate on a 30-year fixed-rate mortgage hit 4.23 percent this week, the lowest since November. U.S. mortgage rates for 30-year loans fell for a fifth week as stock market volatility and weaker-than-expected economic reports drove investors to the safety of the government bonds that guide borrowing costs. The… read more →

The steps we take now can pave the way to our Financial Future. Some good and some bad choices can sway us towards years of debt or a strong Retirement. We chose the top 4 categories that impact your short term and long term Financial future. We rated these choices… read more →

(VIRGINIA) – There has never been a better time to refinance your home. That’s because of a little-known government program called the Home Affordable Refinance Plan (HARP). This allows Americans to refinance their homes at shockingly low rates, and reduce their payments by as much as $4,905 a year. But here’s… read more →

With tightening credit markets, low savings rates and stagnant wages, many first-time homebuyers find themselves struggling to amass a down payment. The solution? Parents! Twenty-seven percent of first-time homebuyers received a down payment as a gift from “the good ol’ bank of mom and dad,” says Walter Molony, economics spokesperson for… read more →

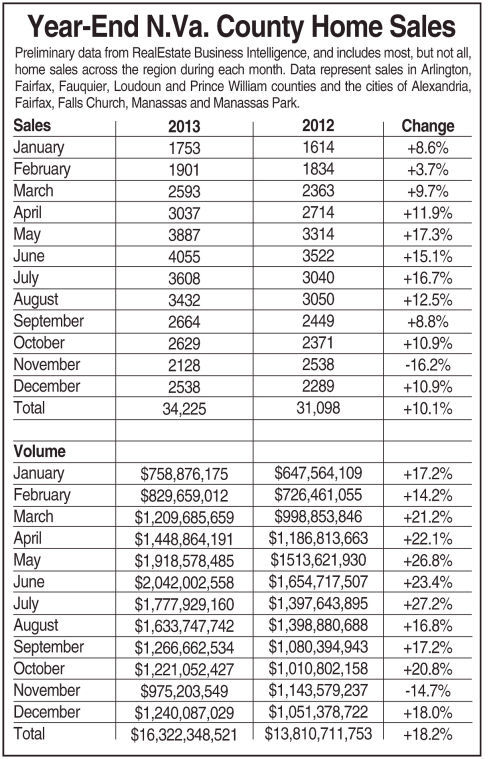

The average sales price for homes that went to closing across Northern Virginia’s inner and outer suburbs in 2013 stood at $476,913, an increase of 7.4 percent from the $444,103 reported a year ago, according to new figures. A total of 34,225 residential properties were sold… read more →

Housing is typically the biggest expense in a household budget. It would be nice to reduce that major expense when you’re retired. Once you are near retirement, you might want to consider downsizing or relocating to somewhere more affordable. There are many choices because you won’t be tied down to a location near your (former) employer.… read more →

Buying your first home is an exciting process, but it can also be a nerve-racking experience. You invest a lot of time and energy seeking out the right home in the right neighborhood. Then the real challenge begins: financing it. Getting a mortgage loan requires you to have enough money in… read more →

For many people, New Year’s resolutions often lose their motivational power by the middle of January. But unlike a commitment to save more or eat less, a resolution to refinance can be accomplished within a few weeks and you can reap the benefits for the rest of the year and… read more →