There’s no doubt about it: Lenders have tightened the guidelines they use to evaluate loan applications. That means borrowers who want to refinance their mortgage to take advantage of low interest rates may wonder whether they will qualify for a new loan. This summary should help you understand what lenders… read more →

If you’re in the market for a new house or condo, you may also need a loan officer to help with underwriting and securing a mortgage. We suggest talking to two or more loan officers to find one who instills confidence. There is a trade-off. Sometimes the best rate doesn’t… read more →

If you’re in the market for a new house or condo, you may also need a loan officer to help with underwriting and securing a mortgage. We suggest talking to two or more loan officers to find one who instills confidence. There is a trade-off. Sometimes the best rate doesn’t… read more →

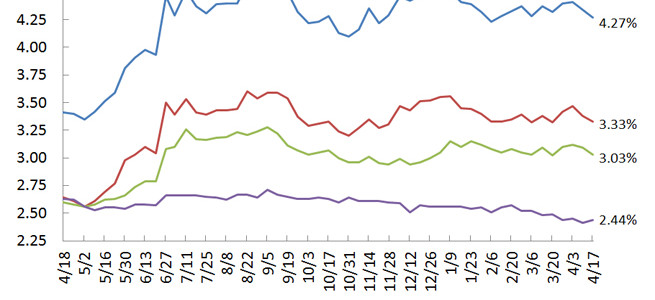

Mortgage rates in the U.S. fell, sending costs for 30-year loans to the lowest since early February as the Federal Reserve confirmed its commitment to provide support for the economic recovery. The average rate for a 30-year fixed mortgage was 4.27 percent this week, down from 4.34 percent, according to… read more →

(VIRGINIA) – There has never been a better time to refinance your home. That’s because of a little-known government program called the Home Affordable Refinance Plan (HARP). This allows Americans to refinance their homes at shockingly low rates, and reduce their payments by as much as $4,905 a year. But here’s… read more →

For many people, New Year’s resolutions often lose their motivational power by the middle of January. But unlike a commitment to save more or eat less, a resolution to refinance can be accomplished within a few weeks and you can reap the benefits for the rest of the year and… read more →