Here Are a Couple Ways That Lenders Determine How Much You Can Borrow: 1. Percentage of Gross Monthly Income Many lenders follow the rule that your monthly mortgage payment should never exceed 28% of your gross monthly income.This will ensure that you are not stretched too far with your mortgage… read more →

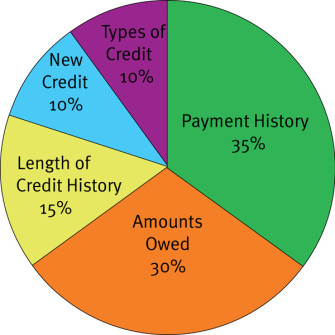

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

Your Glossary to Mortgage Lending Adjustable Rate Mortgage A mortgage loan were the interest rate adjusts periodically based on the changes of a specified index such as the one-year Treasury Bill or the LIBOR. Amortization The calculation of the amount of the installment payment it takes to pay off the… read more →

There are many factors your lender will take into account when assessing the type and quantity of a home mortgage loan you will qualify for. Of course, your credit standing is just one such variable. Good credit has never been more important for obtaining a loan. Your broader financial picture,… read more →

If you’re in the market for a new house or condo, you may also need a loan officer to help with underwriting and securing a mortgage. We suggest talking to two or more loan officers to find one who instills confidence. There is a trade-off. Sometimes the best rate doesn’t… read more →

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

If you’re in the market for a new house or condo, you may also need a loan officer to help with underwriting and securing a mortgage. We suggest talking to two or more loan officers to find one who instills confidence. There is a trade-off. Sometimes the best rate doesn’t… read more →

Your Glossary to Mortgage Lending Adjustable Rate Mortgage A mortgage loan were the interest rate adjusts periodically based on the changes of a specified index such as the one-year Treasury Bill or the LIBOR. Amortization The calculation of the amount of the installment payment it takes to pay off the obligation… read more →

You want to start climbing the property ladder. You want to buy your own home. But there’s just one problem: You don’t have the cash for a 20 percent down payment. What should you do? First, let’s assess your current situation: Are you a first-time homebuyer? Or do you own a home?… read more →

U.S. mortgage rates fell for a fifth week, reducing borrowing costs as home-price gains slow. The average rate for a 30-year fixed mortgage was 4.12 percent this week, down from 4.14 percent and the lowest since October, Freddie Mac said in a statement on Thursday. The average 15-year rate slipped… read more →