The world of mortgage lending has changed significantly since the housing bubble burst. Mortgage lenders have returned to traditional loan standards that require extensive documentation of income and assets for a loan approval. Government regulatory agencies also continue to react to the housing crisis, with more adjustments to mortgage requirements… read more →

When thinking about your New Year’s resolutions, don’t forget to include a few items related to your home and finances. An annual evaluation will help you make sure you’re taking care of your property properly. Check Up on Your Homeowners Insurance Check the limits of your coverage to make sure… read more →

The housing market is now in recovery, and foreclosures have been dropping. Since the housing bust, regulators have focused on preventing borrowers from taking out potentially toxic loans. To help accomplish this, the U.S. government established the Consumer Financial Protection Bureau in 2010. Many potential borrowers are still unsure about… read more →

Home prices will rise in 2014 but at a slower, more steady pace compared with historical trends. The housing recovery has pushed up home prices nearly everywhere. Prices nationwide increased by 10.9 percent, pushing the median price for existing homes up by $30,000, to $215,000. For people who have waited… read more →

Homebuyers who struggled to find a home earlier this year are taking to the market this winter despite colder temperatures and fewer houses for sale a study reports. The report, which surveyed more than 1,300 people looking to buy a home during the winter months, reveals that lingering conditions of… read more →

An improving housing market is great for the economy but not necessarily for first-time homebuyers. According to studies, mortgage rates rose from 3.49 percent in May up to 4.69 percent in August. While rising mortgage rates certainly make transactions more expensive, they shouldn’t deter your purchase. Here are five ways you can buy… read more →

If you’ve been thinking about taking the plunge and buying a home, the last quarter of 2013 might just be the time to do it. Rates on fixed-rate loans are still appealing, and experts say it’s still cheaper to buy than rent. Some financial institutions are also a little more… read more →

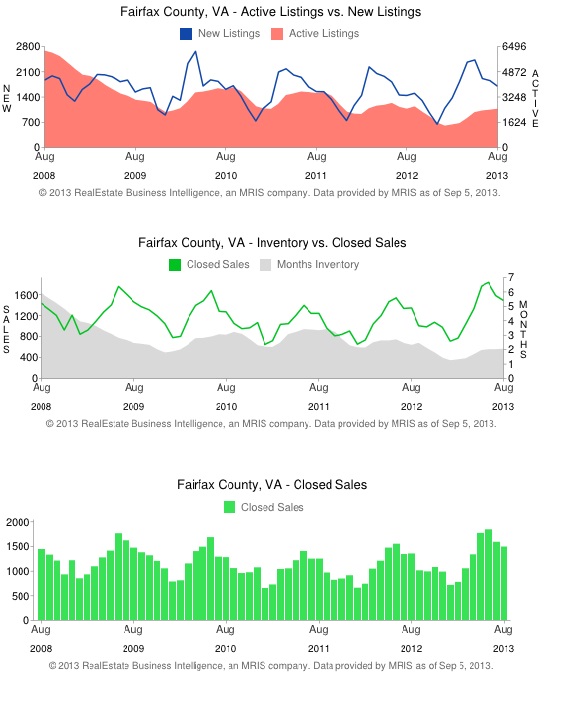

Activity in the Washington DC Metro Region continues to be steady and strong as we enter fall. Sales increased in September as compared to this time last year. Pending contracts also increased, but at a slower rate than earlier this year. The increase in pending contracts was driven by condos… read more →

Beginning this week, thousands of home buyers will be unable to get approvals for their mortgages because of the government shutdown, potentially undercutting the nation’s resurgent housing market. Without paperwork from the Internal Revenue Service, the Social Security Administration and in many cases the Federal Housing Administration, banks and other… read more →

The nation’s housing recovery continues, but the best news is that sales volume in our Northern Virginia footprint has increased by about 12 percent throughout 2013 above the number of homes sold year-to-date last year. August home sales in Northern Virginia continue to defy sequestration and interest rate increases and… read more →