If you’re looking to buy a foreclosure property, a foreclosure auction should be your first stop. When lenders take over properties, foreclosure auctions are your first, and often only, chance to buy the property—but don’t assume getting a deal is a standard practice. To make sure you’re getting the best price,… read more →

Believe in it or not, there are plenty of bad—and good—omens woven into our culture. Whether you’re facing seven years’ bad luck from that broken mirror or carrying around a rabbit’s foot in the hopes of turning your luck around, omens are all around us—even in real estate. If you’re… read more →

Many renters find out, after they’ve already moved in, that not all landlords are created equal when it comes to respecting a tenant’s right to quiet enjoyment of the property. It may be a landlord who mysteriously appears often at the property, one who enters without notice or one who… read more →

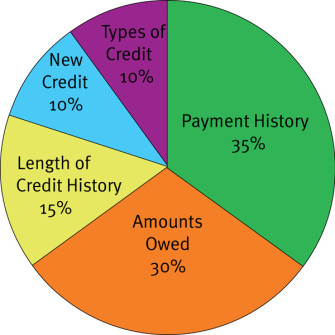

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

Spending less money on utility bills doesn’t mean you need to rush out and purchase a whole new suite of Energy Star appliances. With occasional light maintenance and good habits, you can greatly improve the energy efficiency of your large kitchen appliances—up to about $120 annually—without sacrificing convenience. Refrigerator/Freezer Energy-efficiency… read more →

One question you hear frequently through your 20s is, “When are you going to buy a house?” Some believe you are missing out on the benefits of homeownership, while others think that with careers constantly taking you to new cities, you are better off renting forever. Many people grapple with… read more →

Do you want to pay an extra one or two months’ rent? Of course not!. But your security deposit probably represents one to two month’s rent, and countless renters never see that money again. Here are six tips to avoid losing thousands to lost security deposits. Take Photos or Video… read more →

Your Glossary to Mortgage Lending Adjustable Rate Mortgage A mortgage loan were the interest rate adjusts periodically based on the changes of a specified index such as the one-year Treasury Bill or the LIBOR. Amortization The calculation of the amount of the installment payment it takes to pay off the… read more →

There’s more that goes into buying a home for the first time besides shopping online for mortgage rates. To find the perfect home, you have to log off of the computer, get in your car and see homes for yourself. One way to do that is visiting open houses. First-time… read more →

The latest study from Harvard University found that half of the 43 million renter households in the U.S. spend more than 30 percent of their income on rent payments. A shortage of affordable housing units combined with increased housing costs means it’s more important than ever for low-income, elderly and disabled… read more →