Selling your home requires a keen eye to make it appeal to a wide audience. That means you need to take time to make sure that your home is dressed up and ready to be shown off. It’s sort of an after-thought but it really shouldn’t be. A garage may… read more →

To help you prepare, and to wet your appetite for exploration, Google teamed up with scientists at the NASA Ames Research Center to bring you this collection of lunar maps and charts. This tool is an exciting new way to explore the story of the Apollo missions, still the only… read more →

If the idea of buying a house both scares and excites you, that’s how it should be. If you’re only intimidated or only enthusiastic, you’re probably going into the mortgage-buying process ill-informed. After all, in the years before the Great Recession, homebuyers weren’t intimidated at all. For quite a few… read more →

According to a recent survey of 2,000 homeowners the No. 1 turnoff for prospective homebuyers is the smell of cigarettes. After the smell of stale smoke, homeowners said their biggest home-shopping turnoffs included stained carpets, piles of junk, pet smells and a dirty bathroom. Besides smells and stains, homebuyers said… read more →

The American dream is all about homeownership, right? Actually, the real American dream seems to be about homeownership in a hugely impressive house with all the bells and whistles that’s all decked out and done to the nines and allows you to the keep up with the Joneses. But while… read more →

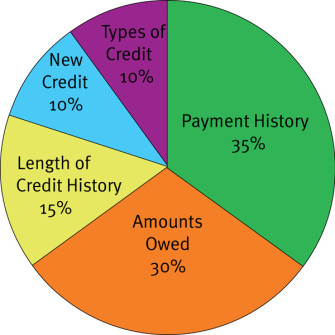

Deciphering your credit score can be difficult, especially if you don’t know all the ways you can be hurting it. Your credit is not only attached to your credit card use, but with many everyday financial activities. Here are five things that can hurt your credit, and ways to prevent… read more →

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

In the wake of the housing bubble’s collapse, FHA loans have taken on renewed importance for today’s mortgage borrowers Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay… read more →

Don’t Make These Mistakes! Not Pre-Checking Credit One way to increase the chance of qualifying for a home loan is for a borrower to check his credit before applying. That way, he can address any issues before they become problems for the lender.

No for-sale house is ever perfect. But some houses are in better shape and consequently easier to sell than others. If yours isn’t one of the stars, but you still need to sell it for the highest possibly price, it’s going to take more than low mortgage rates to attract a… read more →