When you’re house hunting, finding an amazing house in your location of choice that doesn’t require much additional investment seems like a huge score. But is it really? Before making an offer on that picture-perfect home, take a look at the surrounding houses. If they’re all in disrepair—or just obviously less nice… read more →

Here Are a Couple Ways That Lenders Determine How Much You Can Borrow: 1. Percentage of Gross Monthly Income Many lenders follow the rule that your monthly mortgage payment should never exceed 28% of your gross monthly income.This will ensure that you are not stretched too far with your mortgage… read more →

You can get a great deal on real estate owned property, but buying a home owned by a lender comes with some risk. Lenders sell REO properties “as is,” meaning you won’t receive any information about the history of the home. That could create some problems when you go to insure… read more →

In the long run, buying a home can often be cheaper than renting. But until you see the payoff, your wallet may feel some pain. And it all starts with the down payment. (Plus, to avoid private mortgage insurance on a conventional loan, you’ll need to put 20% of the purchase price down… read more →

If you’re looking to buy a foreclosure property, a foreclosure auction should be your first stop. When lenders take over properties, foreclosure auctions are your first, and often only, chance to buy the property—but don’t assume getting a deal is a standard practice. To make sure you’re getting the best price,… read more →

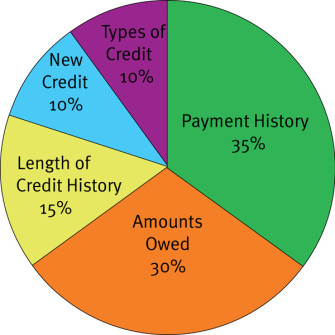

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

Your Glossary to Mortgage Lending Adjustable Rate Mortgage A mortgage loan were the interest rate adjusts periodically based on the changes of a specified index such as the one-year Treasury Bill or the LIBOR. Amortization The calculation of the amount of the installment payment it takes to pay off the… read more →

Don’t Make These Mistakes! Not Pre-Checking Credit One way to increase the chance of qualifying for a home loan is for a borrower to check his credit before applying. That way, he can address any issues before they become problems for the lender.

The American dream is all about homeownership, right? Actually, the real American dream seems to be about homeownership in a hugely impressive house with all the bells and whistles that’s all decked out and done to the nines and allows you to the keep up with the Joneses. But while… read more →

The real estate market is once again in transition. Cash investors are beginning to fade, opening the door for more traditional home buyers, while fast-profit flippers are finding the deals harder to come by – but more profitable than ever. Home purchases made with all cash, representing mostly deals made… read more →