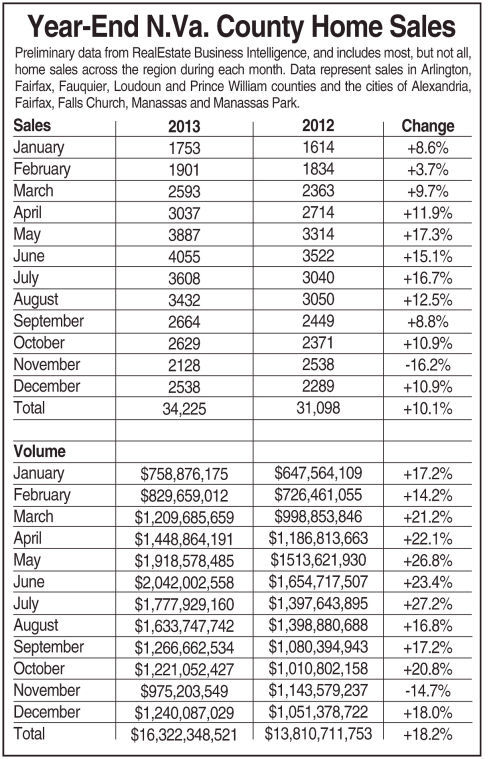

The average sales price for homes that went to closing across Northern Virginia’s inner and outer suburbs in 2013 stood at $476,913, an increase of 7.4 percent from the $444,103 reported a year ago, according to new figures. A total of 34,225 residential properties were sold… read more →

Housing is typically the biggest expense in a household budget. It would be nice to reduce that major expense when you’re retired. Once you are near retirement, you might want to consider downsizing or relocating to somewhere more affordable. There are many choices because you won’t be tied down to a location near your (former) employer.… read more →

Getting a mortgage can mean keeping track of a lot of moving parts. Savvy shoppers know to ask lenders about interest rates, closing costs and how much they can borrow. But even seasoned buyers may not know to dig a little deeper. Here’s a look at five key things that… read more →

It can be quite a struggle to keep a home clean with pets. With proper design planning, you can cut down on the frustration associated with pet hair, dirt and damage to your home! Here are 8 tips to Pet-Friendly Decor! Don’t buy expensive rugs Yes, you can use… read more →

Buying your first home is an exciting process, but it can also be a nerve-racking experience. You invest a lot of time and energy seeking out the right home in the right neighborhood. Then the real challenge begins: financing it. Getting a mortgage loan requires you to have enough money in… read more →

For many people, New Year’s resolutions often lose their motivational power by the middle of January. But unlike a commitment to save more or eat less, a resolution to refinance can be accomplished within a few weeks and you can reap the benefits for the rest of the year and… read more →

The world of mortgage lending has changed significantly since the housing bubble burst. Mortgage lenders have returned to traditional loan standards that require extensive documentation of income and assets for a loan approval. Government regulatory agencies also continue to react to the housing crisis, with more adjustments to mortgage requirements… read more →

When thinking about your New Year’s resolutions, don’t forget to include a few items related to your home and finances. An annual evaluation will help you make sure you’re taking care of your property properly. Check Up on Your Homeowners Insurance Check the limits of your coverage to make sure… read more →

The housing market is now in recovery, and foreclosures have been dropping. Since the housing bust, regulators have focused on preventing borrowers from taking out potentially toxic loans. To help accomplish this, the U.S. government established the Consumer Financial Protection Bureau in 2010. Many potential borrowers are still unsure about… read more →

Real-estate agents say emotional mistakes are common among homebuyers, who sometimes let good deals pass them by. Or worse, buyers overpay for their “dream homes” because they let feelings cloud their judgment. But buyers shouldn’t beat themselves up for getting emotional. Buying a home is often the biggest purchase a… read more →