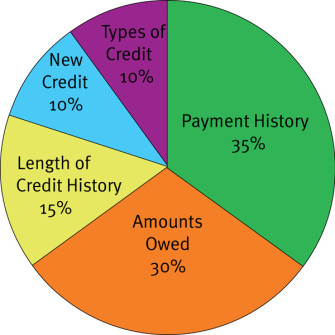

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

Rent is one of the largest monthly expenses for most people and, as a result, dictates the budgeting process. It’s common knowledge you can get kicked out of your place if you fail to pay (that’s usually spelled out pretty clearly in rental agreements), but eviction is only one of… read more →

Sure, you know that having bad credit can mean paying more for a car loan or a mortgage. You know that it means you can pay more to use your credit cards. But did you know that people with bad credit also pay more for their car insurance and sometimes… read more →

Banks are getting very cautious about home mortgage loans these days — right up to the closing date. Even consumers with good credit and plenty of cash may find themselves out on the sidewalk if any of these last-minute loan application issues pop up. To make sure you’re on the right end… read more →

As if the Target data breach wasn’t bad enough, experts say it’s almost inevitable this kind of thing will happen again. There’s already a lot of breaches related to the Target breach that aren’t being disclosed. There is roughly an 80 percent chance another big data breach like the Target mess will… read more →

Love is blind but mortgage companies surely are not. This fact of life is one many newlyweds encounter when hunting for their first home and discover their cumulative credit is far from lovable. So what happens to their “American Dream” when one spouse’s credit is terrific but the other’s isn’t?… read more →

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

Rent is one of the largest monthly expenses for most people and, as a result, dictates the budgeting process. It’s common knowledge you can get kicked out of your place if you fail to pay (that’s usually spelled out pretty clearly in rental agreements), but eviction is only one of… read more →

Sure, you know that having bad credit can mean paying more for a car loan or a mortgage. You know that it means you can pay more to use your credit cards. But did you know that people with bad credit also pay more for their car insurance and sometimes… read more →

Banks are getting very cautious about home mortgage loans these days — right up to the closing date. Even consumers with good credit and plenty of cash may find themselves out on the sidewalk if any of these last-minute loan application issues pop up. To make sure you’re on the right end… read more →