He bristles at your questions about his work history. He says there’s no reason to solicit other contractor bids. His company demands payment up front, in cash. He tells you this is the way renovations get done. Maybe you don’t know any different because this is your first major home… read more →

VA appraisals are a critical part of the 70-year-old VA loans benefit program. It’s also one of the most misunderstood. VA appraisals help ensure veterans purchase homes that are safe, structurally sound and salable. There are two elements: a valuation of the property and an assessment of property conditions. We’ll take a… read more →

It’s closing time: Last call for every entity with even a small role in a home sale to collect their fees. Home buyers—eager to get the keys to their new place—must first cover myriad costs, including agent commissions, attorney fees, lender fees, mortgage insurance, a title search, recording fees, real-estate… read more →

With new home production still well below annual historical averages, chances are you’re buying an older homes that needs some work. Believe it or not, there are loans out there that might suit your needs. If you’re planning to replace systems or appliances, consider an energy-efficient loan. Energy- Efficient Mortgages also… read more →

If the idea of buying a house both scares and excites you, that’s how it should be. If you’re only intimidated or only enthusiastic, you’re probably going into the mortgage-buying process ill-informed. After all, in the years before the Great Recession, homebuyers weren’t intimidated at all. For quite a few… read more →

The American dream is all about homeownership, right? Actually, the real American dream seems to be about homeownership in a hugely impressive house with all the bells and whistles that’s all decked out and done to the nines and allows you to the keep up with the Joneses. But while… read more →

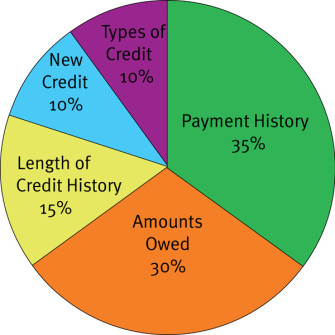

Deciphering your credit score can be difficult, especially if you don’t know all the ways you can be hurting it. Your credit is not only attached to your credit card use, but with many everyday financial activities. Here are five things that can hurt your credit, and ways to prevent… read more →

With the cost of everything rising, included are home renovations. Many couples headed to the altar have taken matters into their hands and come up with a creative new way to finance their new design. Instead of offering guests the typical choices, they sign up for an online cash-gift registry… read more →

Your credit report is essentially your financial report card. It serves as a way for banks, insurance and lending companies to gauge your credit-worthiness and whether you’re likely to miss payments or default on a loan. It’s also common for landlords, employers and government agencies to check your credit before… read more →

In the wake of the housing bubble’s collapse, FHA loans have taken on renewed importance for today’s mortgage borrowers Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay… read more →