5 Factors That Drop Your Credit Score

Watch out for these sneaky score pitfalls that could ruin your credit and keep you from moving into your next place.

Watch out for these sneaky score pitfalls that could ruin your credit and keep you from moving into your next place.

When it comes to major financial transactions, your credit score matters. By now you know there’s no getting around the fact that financial institutions weigh a lot against those three numbers.

But you may not know why your credit score is creeping downward, especially when you’re trying to play it by the book and maintain creditworthiness. So what’s going on to affect your credit poorly?

If you’ve ever checked your credit score only to find yourself shocked and dismayed by the result, your score may be suffering from one of these sneaky things that can ruin your credit.

1. Generating “Hard Inquiries”

When you start collecting quotes on interest rates from various lenders, you’re being financially savvy. Shopping around before choosing an institution for a mortgage or a car loan can help you find the best rate — and that translates into tens of thousands of dollars in savings (if not more!) over the lifetime of your loan.

But there’s a catch. When you receive a quote on interest rates, lenders pull a hard inquiry. This shows up on your credit report. You need to plan so that you can gather quotes in a short period.

Multiple inquiries within a 14-day span are counted together. If you stretch out these inquiries over a longer period, however, each shows up individually. And too many inquiries can ruin your credit.

2. Skipping out on the little things

Think that old library fine from 15 years ago matters today? It could, if the library system turns that account over to collections or marks it as “delinquent.”

Unpaid bills from a variety of sources — including utility bills from previous addresses, medical bills you thought you paid, and so on — can cause your credit score to plummet if they’re unresolved.

In most cases, this is an easy fix and a matter of settling the outstanding payment you owe. To check for these issues, you can pull a free credit report each year.

Which leads us to another credit ruiner…

3. Incorrect Information

You need to pull your credit report regularly for more reasons than to see if your old librarian has financially put you on blast. Errors do occur and businesses make mistakes. If your credit report is harboring incorrect information about your financial records, this could drag down your credit score.

If you pull your report and find an error, call the credit bureau that issued the report. You’ll want to file a claim and start the process of correcting any erroneous data. It can be long and arduous to correct errors, but it’s worth the effort.

4. Utilizing your available Credit a little too much

If you’re a stickler for using your credit cards for everyday spending only and you pay off your balances on time and in full each month, you may be at a loss as to why your credit score still suffers. After all, aren’t you using credit responsibly?

You may be — if you’re only charging what you can afford and not carrying a balance month to month.

You may be — if you’re only charging what you can afford and not carrying a balance month to month.

But what matters here is how much credit you have and how much credit you’re using. For example, if you have a $1,000 line of credit and you charge $999 each month, you’ll earn a black mark on your credit score even if you pay off every bit of that $999.

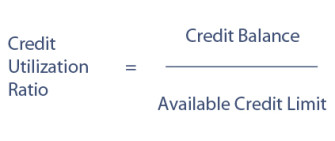

Maintaining a high credit-utilization ratio will hurt your score. Always keep balances low on your lines of credit.

5. Not using credit

Perhaps the sneakiest way to ruin your credit? Not using it at all. If you’re afraid of tripping up and getting into a financial mess, or if you’ve been scared off the idea of using credit by financial “gurus,” you may negatively impact your score.

By not using credit, you don’t create a history that shows you’re a responsible user of credit who can manage balances and payments. Inactive accounts may even default to closed over time, and that too can ding your score.

Whether you feel it’s fair or not, the fact remains that those looking to buy or rent a home need to develop and maintain strong credit scores. If you want to secure the best real estate deals available to you on the market, watch out for these sneaky score pitfalls that could ruin your credit.

– See more at: http://www.trulia.com/blog/5-sneaky-things-you-didnt-know-could-ruin-your-credit/#sthash.MTymbZtS.dpuf

Sorry we are experiencing system issues. Please try again.

Comments are closed.