Rates Are Still at Historic Lows

For the past two months we’ve seen about a 1,000 basis point movement for the worse in the mortgage market which is equivalent to 1% to 2% in an interest rate depending upon your credit score and the program your qualifying for. We haven’t seen activity like this for a very long time and may never see it again.

For the past two months we’ve seen about a 1,000 basis point movement for the worse in the mortgage market which is equivalent to 1% to 2% in an interest rate depending upon your credit score and the program your qualifying for. We haven’t seen activity like this for a very long time and may never see it again.

The main reason for this is that our economy is improving according to Fed Chairman Mr. Bernamke and the economic indicators that have come out recently. Jobless claims lowering, inflation rate lowering, housing appreciation growing along with many others have all been in the favor of our economy growing and getting stronger. One part is that investors will stop investing in safe haven investments such as a mortgae backed securities where they are guaranteed a return and put their money back into a more aggressive market such as stocks (our economy). This raises our interest rates. The other large factor was that the Federal Reserve said they will start pulling away from the purchasing of mortgage backed securities which was the main factor in keeping our interest rates low. While the Federal Reserve was purchasing them this created a demand, so the more demand, the more supply, lower rates. Since they’re pulling away from buying them, the demand is going away and our rates are rising.

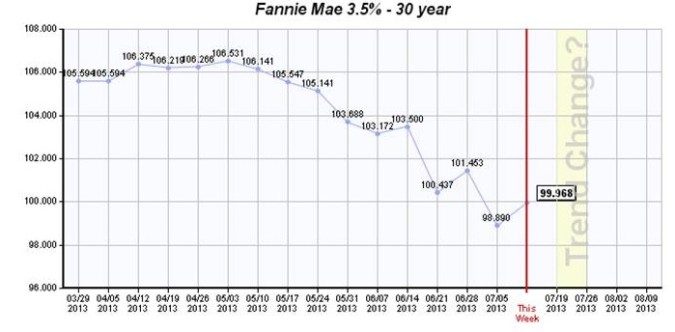

Below is a chart showing you what has transpired the past 16 weeks. As you can see there is a huge drop in the market. This will give you an idea of what we’ve been dealing with.

All in all, over the past 10 years the rates are still at historic lows. As a society we have come to accept these lows as common place and the new standard. This huge jump has caused panic and hesitation because rates are now higher. Historically, we’re still extremely low compared to previous years.